Optical component vendor profits moving toward parity with rest of the supply chain

Sourc:The SiteAddtime:2018/7/4 Click:0

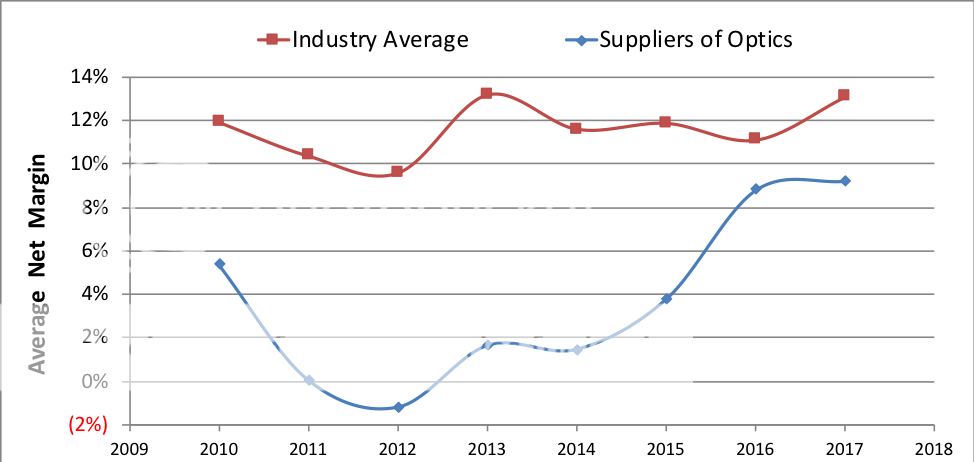

Over the past eight years, Internet Content Providers (ICPs) and vendors manufacturing semiconductor integrated circuits have produced average net margins in the double-digit range. Communication Service Providers (CSPs) and suppliers of networking equipment have averaged in the high-single digits. Optical components vendors had consistently been at the bottom in terms of profitability, averaging at less than 2 percent in 2011-2015. 2016 marked a real change in that for the first time ever, optical component companies were as profitable as CSPs and network equipment makers. This improved profitability extended into 2017 as well, despite lower than expected market growth.

Figure 2-2. Net profit margin of different ICT market segments (sales-weighted)

Source: Companies financial reports

Note: One-time tax expenses and benefits due to the change in U.S. tax laws in 2017 are excluded from the analysis of profitability and from net income figures contained in this report.

NeoPhotonics and Coadna (now part of II-VI Photonics) were the only optical component vendors to report losses in 2017. Lumentum and Oclaro lost money in 2012-2015, but both companies refocused their businesses on more profitable products, improving their financials in 2016-2017. The acquisition of Oclaro by Lumentum will solidify the profitability of the new #1 supplier of optics. Finisar’s profits declined in 2017 and their new CEO is probably taking a very close look at the company’s operations as he makes plans for the future.

The success of new publicly traded companies, including Acacia, Applied Optoelectronics, Eoptolink and Innolight, contributed to the improved profitability of the optical component and module vendor group in 2016-2017.

Investments in research and development (R&D) are a major burden for suppliers of optics. Aggressive targets set by ICPs for development of 400GbE transceivers are forcing suppliers to invest more in product development. Consolidation among suppliers is a proven strategy for reducing R&D expenses of the industry. Lumentum’s latest acquisition is certainly a step in the right direction and we expect to see more deals in 2018-2019.

The State of the Optical Communications Industry Report provides a holistic analysis of the global communications industry, during a period of unprecedented growth in demand for broadband connectivity and the rise of Cloud companies. It examines business strategies of ICPs and CSPs, as well as their suppliers of networking equipment and optical/ electronic components.

A detailed analysis of revenue growth and profitability across different levels of the industry supply chain in 2010-2017 is used to identify challenges and opportunities for the future. The report also includes a review of the latest mergers and acquisitions across the industry and their impact on the market landscape.

The report takes a deeper look at suppliers of optical components and modules, providing market shares of leading vendors sorted into the several categories (top 3, top 4–6, top 7–10, and other vendors). It includes market share ranking and data on diversification of the top 12 leading suppliers of optical transceivers, segmented into SONET/SDH, High Speed Ethernet, Low Speed Ethernet, Fibre Channel, WDM, FTTx, Wireless, and Optical Interconnect (AOCs/EOMs) categories. More than 20 of the leading component vendors shared confidential sales data with LightCounting to support this study.

The success of Chinese equipment and component suppliers is evaluated and many Chinese component vendors are profiled, including 10Gtek, Accelink, APAT, Broadex, Eoptolink, Gigalight, HG Genuine, Hi-Optel, HiSense Broadband, Hytera EMS, Innolight, Lightip, Linktel, O-Net, RUIGU, Sinovo, Sunsea, Sunstar, Tsuhan S&T and Xiamen San-U.

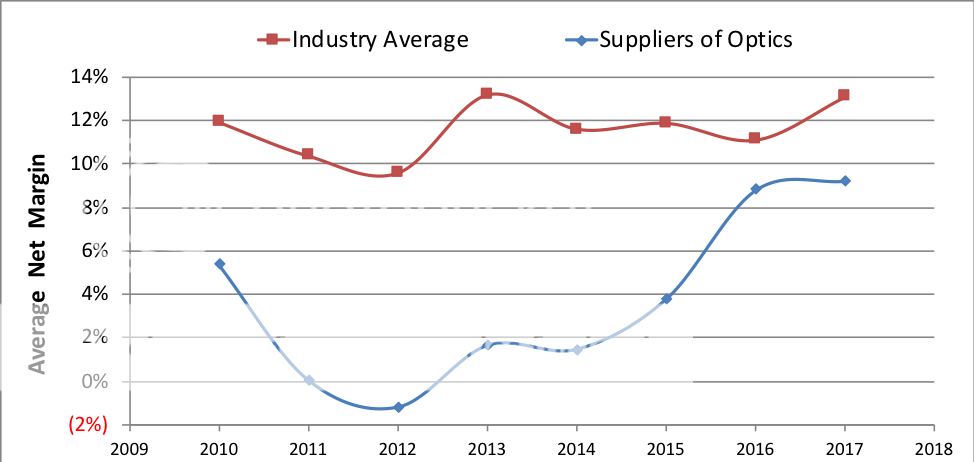

Source: Companies financial reports

Note: One-time tax expenses and benefits due to the change in U.S. tax laws in 2017 are excluded from the analysis of profitability and from net income figures contained in this report.

NeoPhotonics and Coadna (now part of II-VI Photonics) were the only optical component vendors to report losses in 2017. Lumentum and Oclaro lost money in 2012-2015, but both companies refocused their businesses on more profitable products, improving their financials in 2016-2017. The acquisition of Oclaro by Lumentum will solidify the profitability of the new #1 supplier of optics. Finisar’s profits declined in 2017 and their new CEO is probably taking a very close look at the company’s operations as he makes plans for the future.

The success of new publicly traded companies, including Acacia, Applied Optoelectronics, Eoptolink and Innolight, contributed to the improved profitability of the optical component and module vendor group in 2016-2017.

Investments in research and development (R&D) are a major burden for suppliers of optics. Aggressive targets set by ICPs for development of 400GbE transceivers are forcing suppliers to invest more in product development. Consolidation among suppliers is a proven strategy for reducing R&D expenses of the industry. Lumentum’s latest acquisition is certainly a step in the right direction and we expect to see more deals in 2018-2019.

The State of the Optical Communications Industry Report provides a holistic analysis of the global communications industry, during a period of unprecedented growth in demand for broadband connectivity and the rise of Cloud companies. It examines business strategies of ICPs and CSPs, as well as their suppliers of networking equipment and optical/ electronic components.

A detailed analysis of revenue growth and profitability across different levels of the industry supply chain in 2010-2017 is used to identify challenges and opportunities for the future. The report also includes a review of the latest mergers and acquisitions across the industry and their impact on the market landscape.

The report takes a deeper look at suppliers of optical components and modules, providing market shares of leading vendors sorted into the several categories (top 3, top 4–6, top 7–10, and other vendors). It includes market share ranking and data on diversification of the top 12 leading suppliers of optical transceivers, segmented into SONET/SDH, High Speed Ethernet, Low Speed Ethernet, Fibre Channel, WDM, FTTx, Wireless, and Optical Interconnect (AOCs/EOMs) categories. More than 20 of the leading component vendors shared confidential sales data with LightCounting to support this study.

The success of Chinese equipment and component suppliers is evaluated and many Chinese component vendors are profiled, including 10Gtek, Accelink, APAT, Broadex, Eoptolink, Gigalight, HG Genuine, Hi-Optel, HiSense Broadband, Hytera EMS, Innolight, Lightip, Linktel, O-Net, RUIGU, Sinovo, Sunsea, Sunstar, Tsuhan S&T and Xiamen San-U.